Monetary Preparation Suggestions For The Average Guy

Monetary Preparation Suggestions For The Average Guy

Blog Article

Have you ever felt distressed when attempting a brand-new dish (specifically for visitors?) You stress whether it will end up right. Not only is the success of the celebration on the line, perhaps your reputation in the kitchen area is too. Retirement preparation and investing can stimulate a comparable sense of stress and anxiety, though naturally the stakes are much higher. In both cases, we have a keen interest in the outcome, matched with a sense of uncertainty about what that result might be. As someone who has spent years doing both professionally - cooking and providing retirement/investment assistance - I provide some suggestions from the kitchen that can be used to successful preparation for the future.

IRA is an account you can set up in a bank, an insurance provider or any safe financial organization. The objective is to deposit a portion of your earnings in this account in a regular basis. The money in the account is of course not going to lie there waiting for you to retire. This cash is going to be spent for different things such as realty, stock certificates and so on.

So when you think of retirement preparation, believe about your triumph lap. What will you be doing day to day? What brand-new experiences do you anticipate? What is it that you really wish to accomplish? Where will you be living?

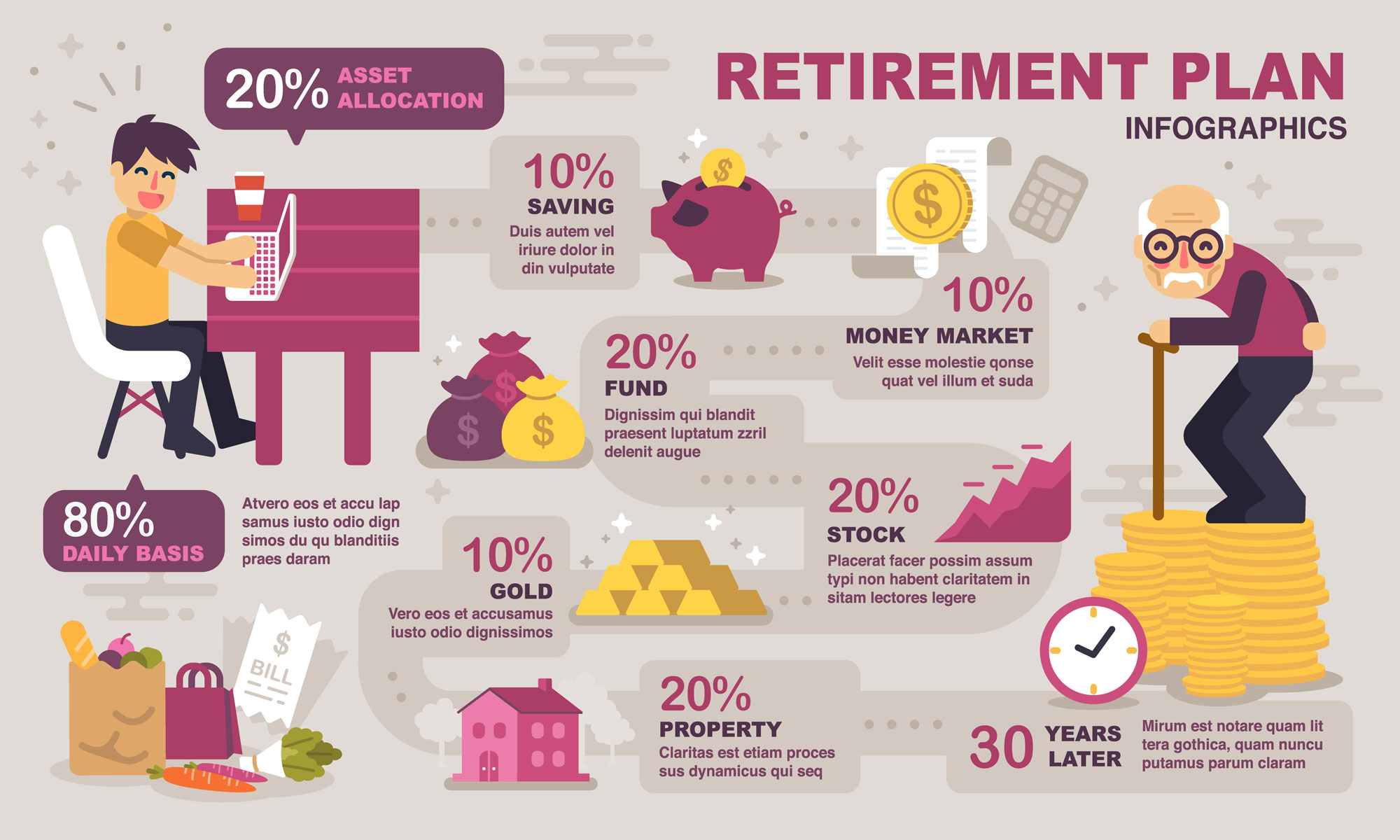

retirement planning involves determining what you want and what you need. Then developing a strategy to attain them, acting upon this strategy, examining and modifying your plan as the retirement years approach.

Saving isn't enough. The old guideline said that if you saved regularly you would be rewarded with a comfortable retirement through the impact of compounding. Supplying you with the nest egg you need to retire.

Now that you are conscious of it, why not make your dreams come to life? To make your dreams become a reality, you must have a concrete strategy. A dream without a plan is simply a simple dream. So make your dreams happen!

Accept that the world retirement planning is altering and will never be the very same as it was in the past. Accept the change, be versatile and adjust as things change around you. Wishful thinking needs to not be the basis for your retirement planning. "It is not the greatest of the types that make it through, not the most intelligent, but the one most responsive to alter"-- Charles Darwin.

There are plenty of retirement planning tricks that you can get to know more about from your other family and friends members that are preparing or going through their own retirement. They can help you discover more about what is going on and what to expect. You need to consider your retirement preparation as early in life as you can so that you are providing yourself more of a better chance to have the earnings waiting there for you when you do lastly get to retire.

Report this page